Master the basics of economic accounting with our Accounting for Financial Analysts Course. This comprehensive program presents over 16 hours of expert-led video tutorials, guiding you through the preparation and analysis of income statements, stability sheets, and money flow statements. Achieve hands-on expertise with Excel-based monetary modeling, real-world case studies, and downloadable templates. Upon completion, earn a recognized certificates to enhance your career prospects in finance and investment. Businesses should observe invoices, deal with disputes, ship reminders, and apply funds appropriately.

However, it also means parting with money sooner than needed, which might potentially affect liquidity if not managed correctly. Advance funds assist producers missing capital for materials by letting them use the funds to create the product. It may also be used as an assurance that a sure quantity of revenue will be introduced in by producing the large order. If an organization is required to make an advance payment, it’s recorded as a pay as you go expense on the steadiness sheet beneath the accrual accounting methodology.

In the realm of accounting, monitoring advance payments is a important task that requires meticulous attention to detail and robust technological support. Advance payments, usually categorized as deferred revenue, characterize a monetary obligation to ship services or products in the future. As such, companies should employ effective strategies to observe these funds to ensure correct financial reporting and compliance with accounting standards. From the perspective of a CFO, the power to forecast cash circulate is enhanced by exact monitoring, whereas auditors seek clear and verifiable data to validate the integrity of economic statements.

Money Application Administration

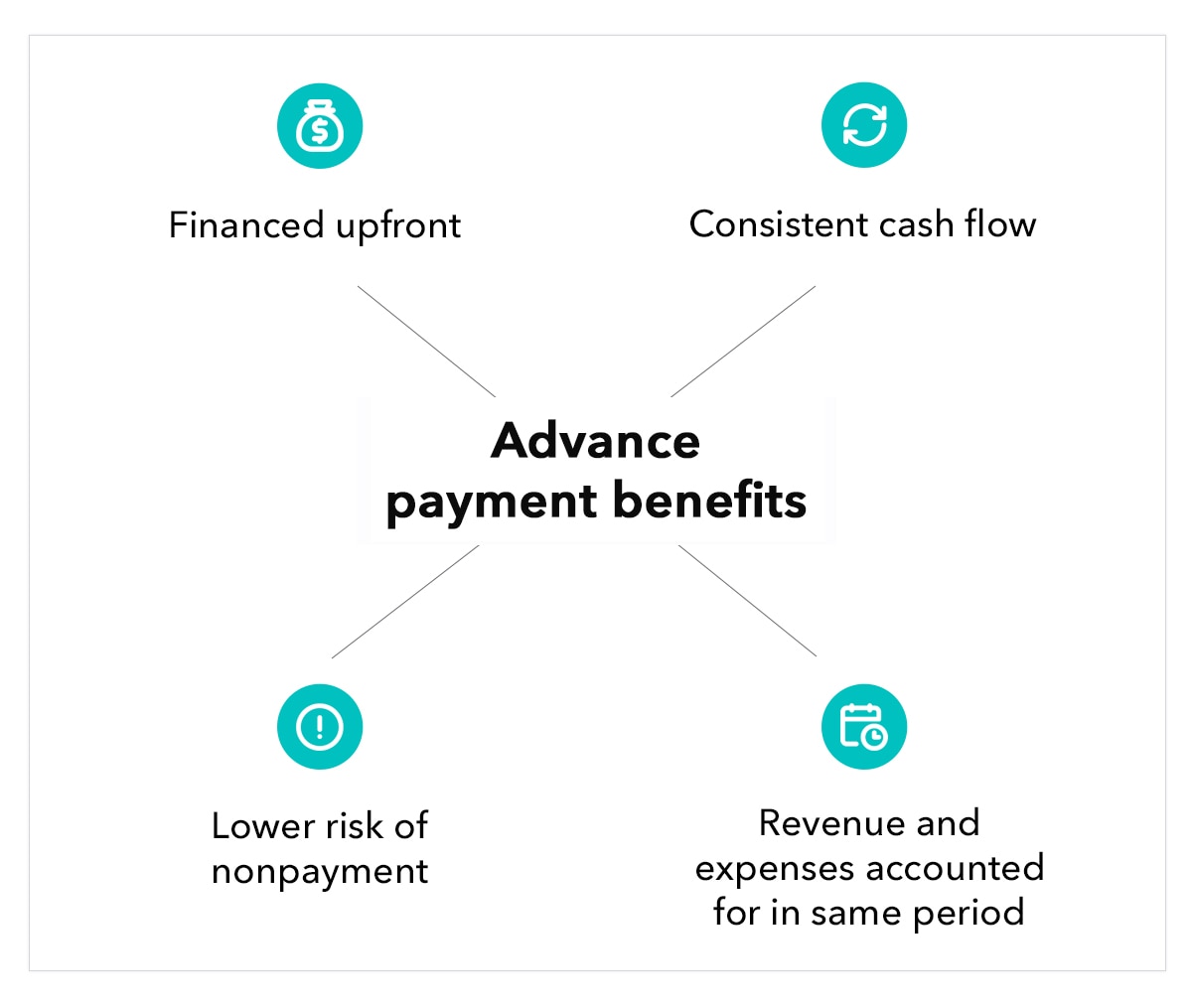

Whereas getting your cash upfront would possibly appear to be it will only benefit your business, there are pros and cons to advance funds. Once items or companies are rendered, this quantity could be transferred to the income assertion as earned income. To collect advance fee, your business will need to estimate the finances for the goods or providers being bought. It’s essential to be as correct as possible as a result of it’ll cut back the chance of overcharging and having to issue a refund or reimbursement. Without a doubt, advance tax can be a beneficial type of doing business for both the buyer and vendor.

Advance payments are quantities paid before a good or service is definitely obtained. In these instances, goods or services are delivered first, then paid for later. For instance, an employee who’s paid at the end of every month for that month’s work can be receiving a deferred cost. To avoid confusion, create an organized naming convention for legal responsibility accounts associated to advance funds. The buyer has to make fee for the pay as you go cellular phone prematurely to enjoy its profit for a month. The service supplier only offers service for one month when it receives the prepayments.

Highradius Named As A Pacesetter In The 2024 Gartner® Magic Quadrant™ For Invoice-to-cash Functions

From the attitude of company treasurers, the longer term is likely to convey more refined forecasting instruments that may predict money flow wants with larger accuracy, allowing for extra strategic use of advance funds. On the other hand, customers are on the lookout for flexibility and convenience, driving the demand for digital wallets and payment platforms that can handle advance funds seamlessly. Customers with bad credit may be required to supply creditors with advance payments before they will buy goods or services.

- Roughly 1,four hundred staff were to be positioned on furlough, while 375 employees would continue to work, the agency said.

- Let us perceive how advance payment tax and different entries could be made for each the buyer and vendor.

- They are recorded as belongings on the balance sheet and expensed once supply is accomplished.

- In this case, fee advances from customers can help construct trust between a provider and its new shopper.

- It ensures that income is matched with the bills incurred to generate that revenue, providing a extra correct image of a company’s financial performance.

It’s a delicate stability, however when accomplished accurately, it may possibly result in stronger business relationships and improved monetary stability. An advance payment is a prepayment technique, the place a purchaser can pay money to the payee before receiving the products or services. In another example, a construction firm working on a multi-year project may obtain advance payments. The company uses the percentage-of-completion method to recognize income as work progresses, primarily based on costs incurred or milestones reached, rather than waiting till the project’s completion. The treatment of deferred revenue has significant implications for financial evaluation, tax planning, and business operations. It Is important for businesses to handle and report this kind of income precisely to supply a clear image of monetary health and adjust to regulatory standards.

Primarily, ASC 606 mandates that revenue is earned and recognized solely when the efficiency obligation is happy, not simply when the fee is collected. Properly accounting for these buyer prepayments begins with the preliminary receipt of money, a crucial first entry that sets the inspiration for accurate financial reporting. The way forward for advance funds in business transactions is brilliant, with know-how enjoying a pivotal function in shaping its trajectory.

Not only does it involve further dangers, such because the potential for overcharging purchasers and having to problem refunds, but the accounting necessities are also extra involved. Advance funds made to suppliers are recorded as a prepaid expense on the balance sheet—as long as your corporation uses the accrual accounting methodology. One of the biggest dangers companies take is providing goods and providers with out cost. While businesses usually do issues this manner, that doesn’t mean there isn’t an alternative choice. As An Alternative, you would choose to require advance payments in your goods and providers, or simply for sure initiatives. Peakflo supplies real-time monetary information, so companies always know their cash move.

Relying on the nature of the transaction, funds prematurely could also be required before the products are shipped or earlier than a service is completed. Equally, a small enterprise proprietor might https://www.personal-accounting.org/ use a blockchain-based platform to send advance payments to an overseas contractor, having fun with the advantages of swift transactions and lowered switch charges. Advance payments contain funds paid earlier than receiving items or services, typically as a protective measure for sellers in opposition to nonpayment. They are recorded as assets on the steadiness sheet and expensed once delivery is accomplished. Accepting advance payments may be rather more complicated than billing in arrears.

On one hand, it allows businesses to recognize revenue at a time that might be extra favorable for tax functions. On the other hand, it requires cautious planning to ensure that how to account for advance payments 9 steps with the popularity of revenue does not lead to money flow issues, especially if the precise money is not but in hand. These kinds of companies incessantly use advance billing buildings, although they could have to offer advance fee guarantees to convince certain shoppers. These contract clauses explicitly state that the consumer will get their advance funds again if the seller fails to ship. Some companies offer refunds if a buyer cancels before receiving a service. If an organization information an advance cost as revenue too soon, refunding it later may cause monetary problems.